In this year’s annual Global Compass wine market attractiveness report, Russia has shot up 23 places into the top 10 – partly due to Russia’s younger generation of well-travelled adults swapping their parents’ vodka for wine.

For the past seven years, Wine Intelligence has set out to measure the relative attractiveness of the 50 leading wine consumption markets around the world. The resulting annual report, Global Compass, has proven to be an enduring hit with our client base, allowing them to compare their own performance and forecasts to a non-aligned benchmark. It has also allowed clients to see whether they are allocating their marketing and sales resources appropriately, and if there are opportunities that demand more attention than is currently budgeted.

As with many things, this year’s version of Global Compass, our 8th, has had to be adapted to the COVID-19 era. We have adjusted our market attractiveness model to include forecast GDP change over the next 12 months, to try to take account of the major economic dislocation arising from the coronavirus and associated restrictions.

However, it is important to note that the model is more heavily weighted to longer-run datasets covering economic and also wine market measures. Having composite measures means that no single factor, on its own, can be a game-changer. It also reflects the fact that a long, complex and varying sequence of economic, supply chain, regulatory, commercial and behavioural factors influences a bottle of wine’s journey from vineyard to the consumer’s table.

© Igor Rodin

As a result of these multiple inputs, every year one of the most interesting meetings of our Reports team is the unveiling of the new top 50 and the changes from the previous year. Some of the results are in line with what we expected, but some come as a surprise. This year´s big surprise is Russia, which jumped 23 places directly into 10th most attractive still wine market in the world. Such big jumps aren’t common in our year on year tracking.

Because Compass uses many different variables as input, it is possible to understand quantitatively, and as a first look, what drives such movements in attractiveness from one year to another. Why is Russia suddenly in the radar of the most attractive wine markets globally?

What the data tells us:

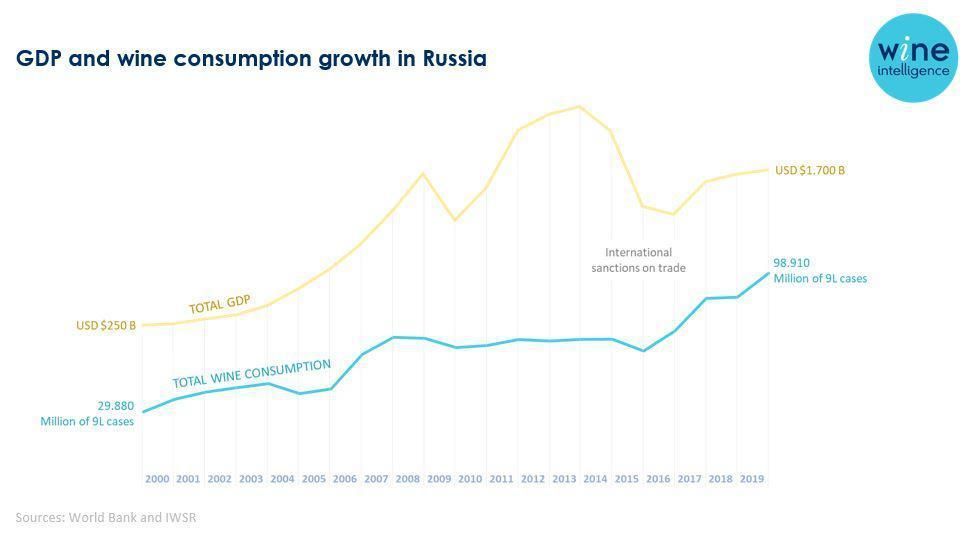

- Wine consumption volume in Russia has been growing at a 13.2% compound annual growth rate since 2015

- Over the same period, value grew faster at a 20.9% compound annual growth rate meaning Russian consumers are not only increasing the amount of wine they drink, they are also paying more for each bottle they buy

- Not surprisingly, per capita consumption doubled

- GDP and wine consumption growth in Russia ©wineintelligence.com

GDP and wine consumption growth in Russia ©wineintelligence.com

It is true that back in 2015 the Russian economy suffered from international sanctions imposed after the annexation of Crimea. Wine was particularly impacted with the Russian authorities imposing higher import taxes for wine from abroad. However, at the same time some positive internal forces were developing and now, after five years, the landscapes of Russia´s wine market is significantly different.

In our subsequent conversations with Russian market experts, the story seems to very similar to what we have seen before in other markets when the maturity curve starts evolving from the ‘emerging’ status. In Russia, a new generation of consumers around the Gen Z / Millennium cohort (currently between 20 and 35 years old) is now the most international and most travelled generation in Russia´s recent history. Understanding the difference between Russian Millennials and Russian older generations is the key to understanding why wine seems to be experiencing a boom.

© Vanya Berezkin

In common with young people everywhere, younger Russians want to be less like the older Russians. The younger want to distance themselves from the high-alcohol drinking to show off toughness by choosing lower-alcohol drinking to show off sophistication. Strong alcoholic beverages, particularly Vodka, occupy an important space in Russian culture and are pretty much associated with tough drinking. Wine, in other hand, seems to be a logic alternative for those seeking a more cosmopolitan and international lifestyle.

When there is demand, the market adapts. Previously, when most wine consumption was concentrated in Moscow among the moneyed elites, one could only find high end products being sold at big markups by a smaller group of old-fashioned wine shops. Nowadays, convenience oriented wine shops, or alcomarkets, have been popping up in many Russian cities, offering a larger portfolio of alternatives in terms of origin, type and price-points, making the category significantly more available for consumers.

© Vanya Berezkin

Another relevant force in the market is the fact that this year, for the first time in the country’s history, Russia has enacted a federal law for wine. The Law on Viticulture and Wine was approved by the Russian Parliament and signed by President Putin at the very end of 2019. Leonid Popovich, the president of the Russian Vintners and Winemakers Union, says: “The very fact that we now have a special law on wine is the most important. The Russian wine industry had grown to the size when it really needed such a law. It is an important signal for investors.”

This law doesn´t justify the rapid growth in the past years because it is very domestic wine centric, but it gives a positive sign to the industry and the wine market in general as for the first time Russia created definitions for ‘wine’, ‘terroir’ and ‘bulk wine’, as well as introduced new categories such as ‘grape-containing drinks’.

The Compass Report 2020 is largely based on market data collected all the way up to the end of 2019. We don´t know yet the full extent to which Covid has impacted the Russian market, compared to other markets. But it is our view that these internal forces bring enough reassurance to believe in the sustainability of such rapid growth. What we are observing is quite meaningful and it is our view that Russia is a market to at least keep an eye on over the next few years.

Cover photo: © Igor Rodin.